The U.S. housing market looks drastically different than it did before the pandemic, creating numerous challenges for prospective homebuyers.

The median sales price of a home skyrocketed from $329,000 in the first quarter of 2020 to over $420,000 in the third quarter of 2024. In tandem, typical mortgage rates more than doubled since 2021 and remain above 6.0%. While increased prices and borrowing costs have slowed home sales over the past two years, the U.S. housing supply is still inadequate for the current population and anticipated growth.

Adding to these challenges, a growing number of older Americans are opting to receive eldercare at home rather than in institutional settings, creating less supply and more competition for younger buyers.

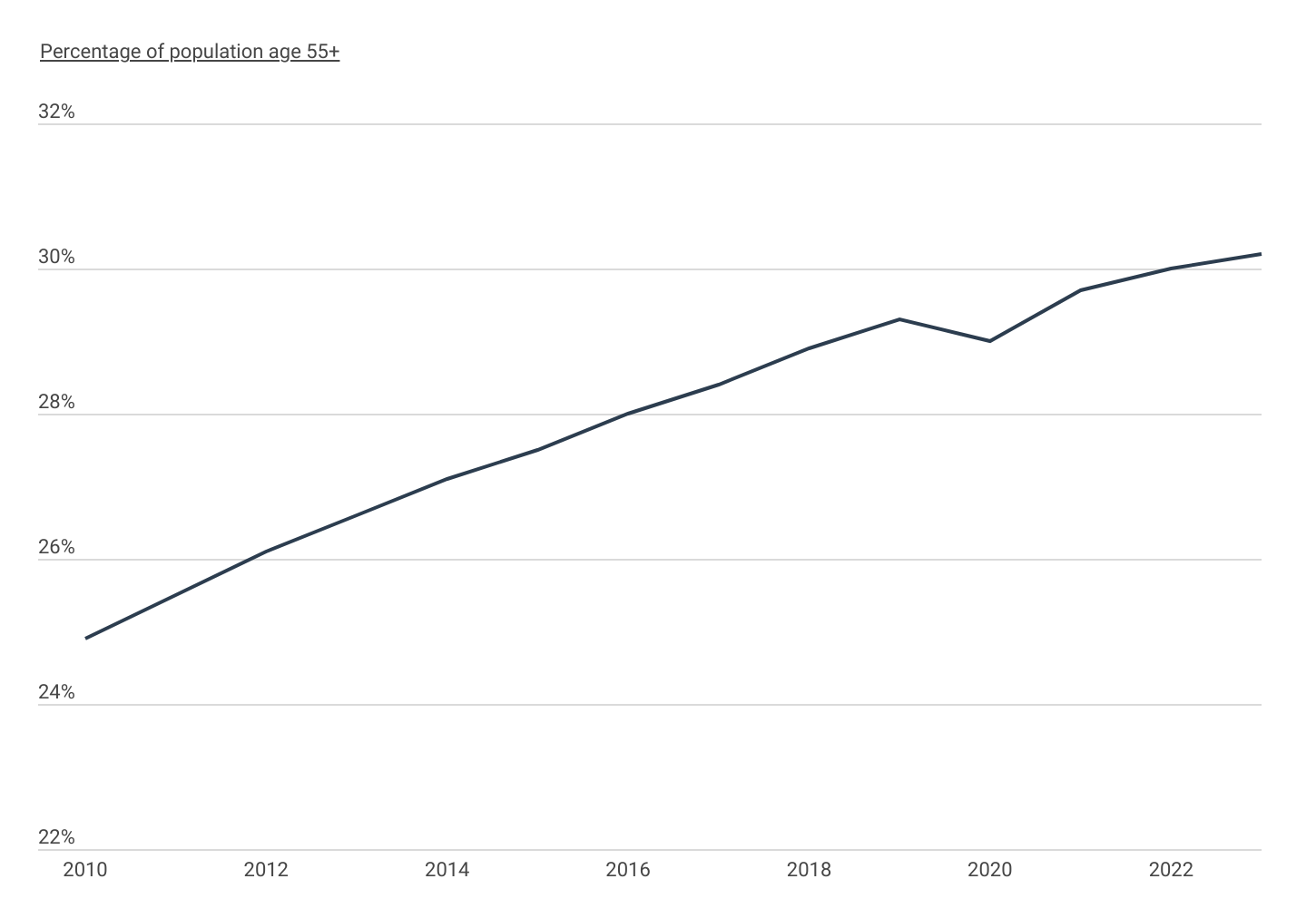

The Growing Share of Older Americans

The share of the U.S. population ages 55 and older has been growing steadily for the past decade

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

The aging of the Baby Boomer generation—those born between 1946 and 1964—has significantly increased the share of the U.S. population aged 55 and older over the past decade. This age group has grown from 24.9% of the population in 2010 to 30.2% in 2023. Despite representing less than one-third of the total U.S. population, adults aged 55 and older now hold over 60% of household real estate wealth.

Unlike prior generations, many older Americans today are choosing to age in place, a trend that limits the flow of existing homes onto the market and restricts the supply available to new buyers. By staying in their current residences, these older homeowners reduce the number of properties typically entering the market, adding to the housing shortage.

At the same time, other older adults are choosing to downsize rather than move to institutional care settings. This shift often leads them to seek smaller, more affordable homes—properties that are also popular with younger buyers. Taken together, younger homebuyers today face more competition for even fewer homes.

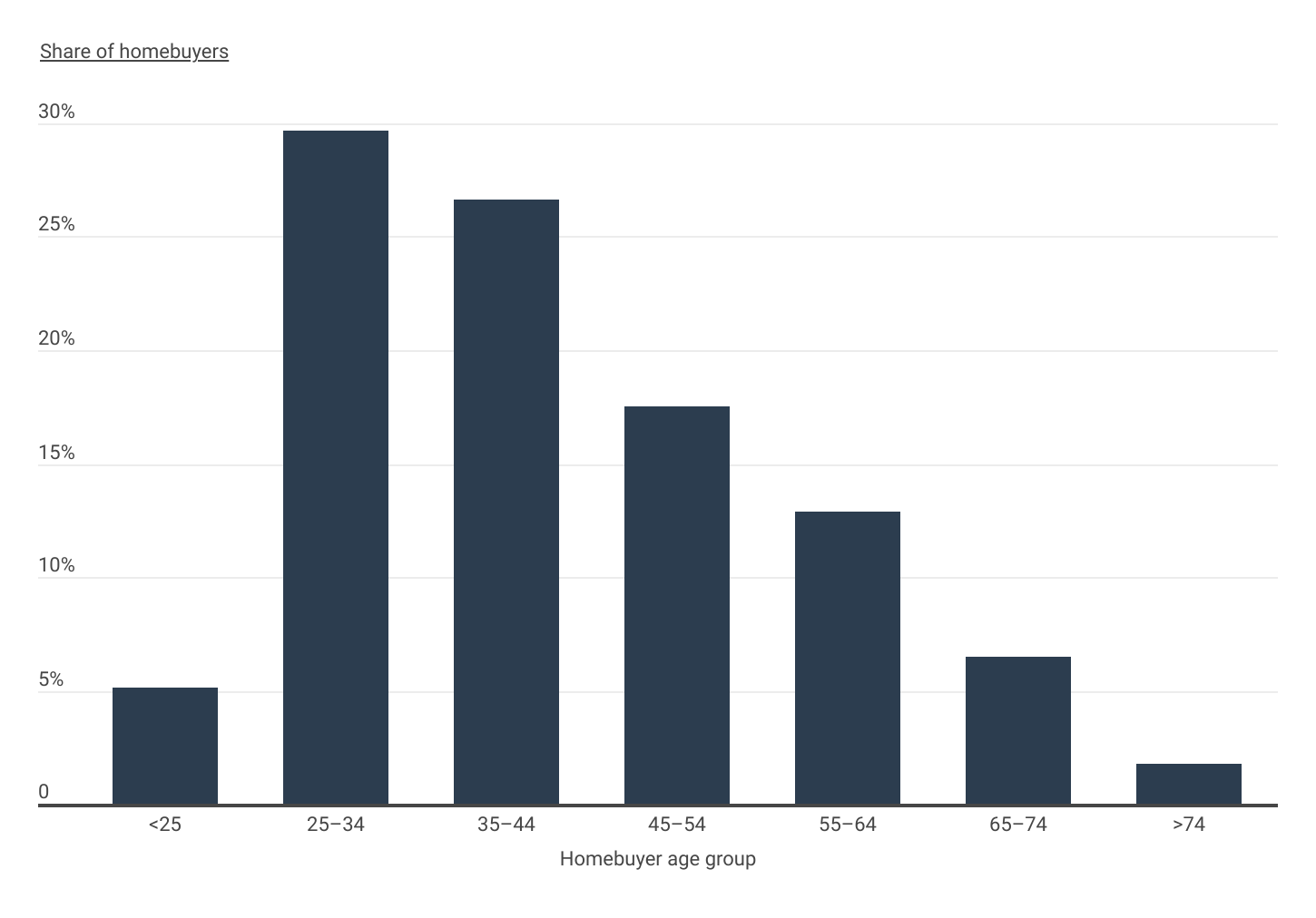

Homebuying Composition by Age

Homebuying dramatically decreases with age

Source: Construction Coverage analysis of FFIEC's Home Mortgage Disclosure Act data | Image Credit: Construction Coverage

While homebuying activity generally decreases with age, Americans over 55 still accounted for a substantial 21.2% of buyers nationally in 2023. Older homebuyers, often driven by lifestyle shifts such as downsizing or relocating for retirement, tend to have financial advantages that benefit them in today’s market. With greater accumulated savings and home equity, they are often better equipped to make substantial down payments, secure favorable financing, or pay with cash.

In contrast, younger buyers tend to have limited savings and little to no existing home equity. Although buyers aged 25-34 represent 29.7% of the market, they often struggle to compete with older buyers whose financial resources provide advantages.

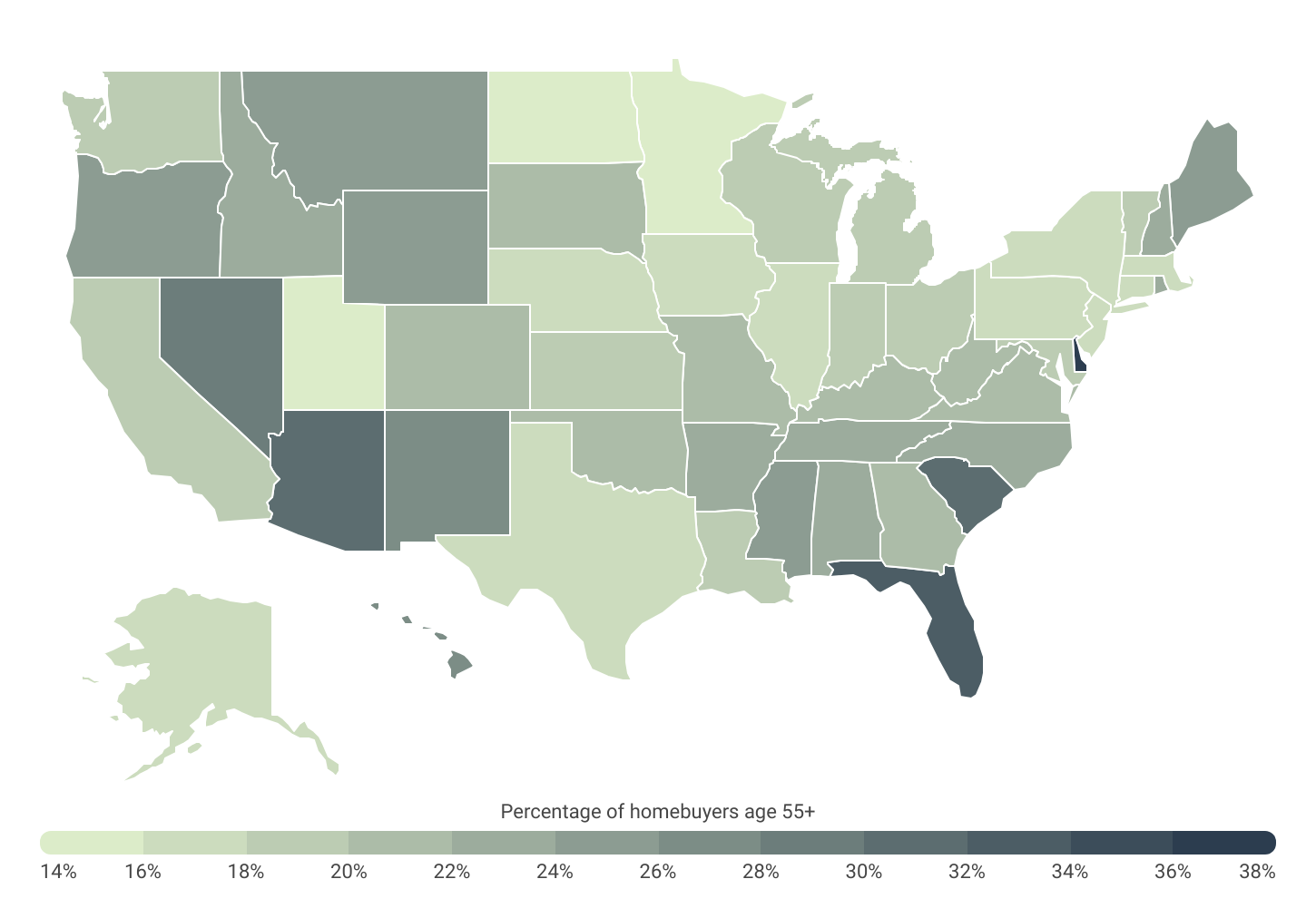

Where Older Homebuyers Are Most Active in the Market

Delaware has the highest percentage of homebuyers over 55

Source: Construction Coverage analysis of FFIEC's Home Mortgage Disclosure Act data | Image Credit: Construction Coverage

While buyers over 55 account for just over 21% of all homebuyers nationally, the numbers vary widely by state. In Delaware, nearly 38% of homebuyers are 55 or older—the highest rate in the country. Other popular states for older homebuyers include Florida (32.1%), South Carolina (31.3%), Arizona (31.2%), and Nevada (28.8%), all of which are popular among retirees due to their warmer climates, lower costs, and recreational opportunities.

In contrast, colder climates generally attract fewer older homebuyers, with some exceptions like Maine, Wyoming, and Montana. States such as North Dakota, Utah, Minnesota, and New York see relatively low shares of homebuyers aged 55 and over, each with 16% or less. Overall, the Midwest and Northeast have some of the lowest rates of older homebuyers, as these regions are typically less popular for retirement or second homes compared to warmer, sunnier areas.

Similar trends hold at the local level, with cities in Florida, Arizona, South Carolina, and Nevada attracting large numbers of older buyers. In contrast, major job hubs like San Jose, CA and Austin, TX report far more young people buying homes.

The analysis was conducted by Construction Coverage, using data from the Home Mortgage Disclosure Act. To determine the locations with the oldest homebuyers, researchers calculated the percentage of homebuyers that are age 55 and older.

Here is a summary of the data for South Carolina:

- Percentage of homebuyers age 55+: 31.3%

- Percentage of homebuyers age 65+: 12.9%

- Percentage of homebuyers age 75+: 2.4%

- Median home purchase price (homebuyers age 55+): $365,000

- Median home purchase price (all homebuyers): $345,000

For reference, here are the statistics for the entire United States:

- Percentage of homebuyers age 55+: 21.1%

- Percentage of homebuyers age 65+: 8.2%

- Percentage of homebuyers age 75+: 1.8%

- Median home purchase price (homebuyers age 55+): $405,000

- Median home purchase price (all homebuyers): $395,000

For more information, a detailed methodology, and complete results, see American Cities With the Oldest Homebuyers on Construction Coverage.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.